Action Needed to Save U.S. Public Education

From the Network for Public Education:

The stakes could not be higher.

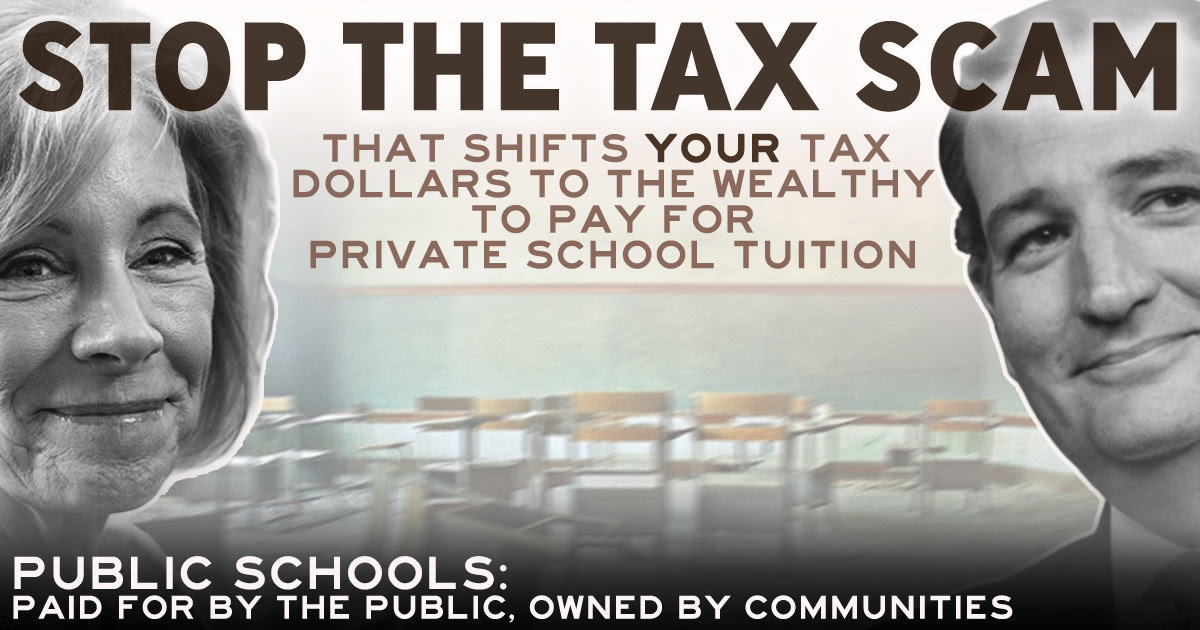

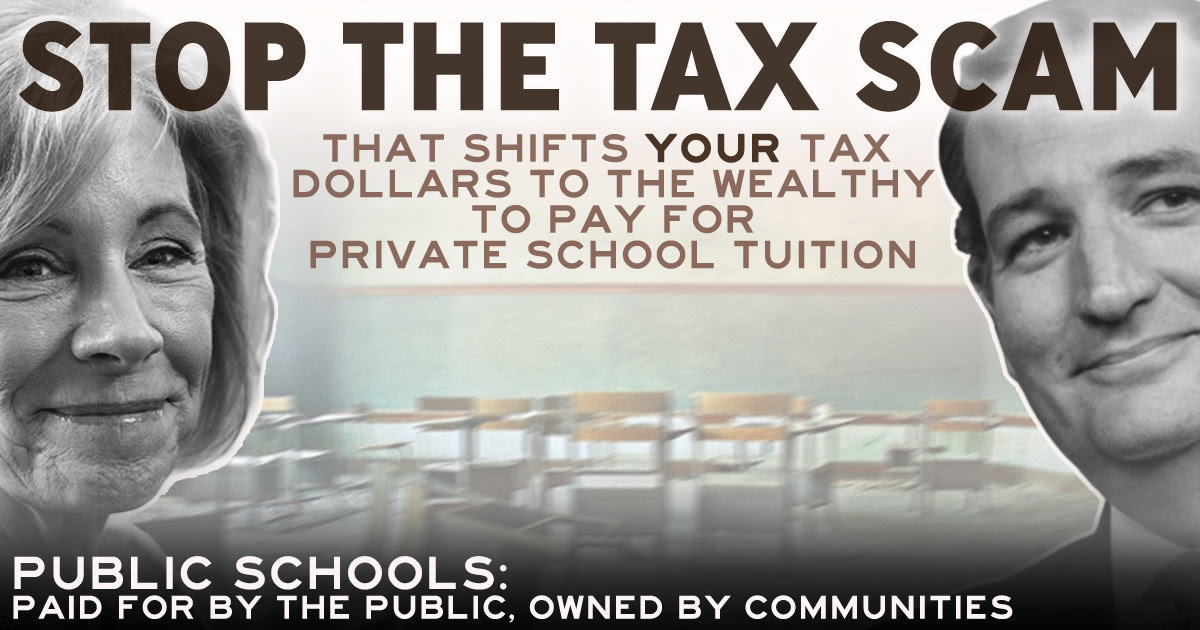

If the GOP tax bill passes, your federal tax dollars will be used to support the private and religious school tuition of any student, no matter how wealthy, in every state.

The tax bills of both the House and Senate would allow wealthy families like the Trumps and the DeVoses to divert up to $10,000 a year in taxable dollars to pay K-12 private school tuition.

What the rich should pay in taxes, will instead pay for elite private and religious school tuition--even to schools that discriminate against students based on race, religion, gender, primary language, disability and LGBTQ status. The wealthy could take advantage of this tax scam before their child is even born.

Tell your representatives to take out the expansion of 529 accounts. Tell them to fully restore the SALT deduction instead. Send your email here.

Make

no mistake. The ultimate goal of this scam's proponents (who include

Ted Cruz and Betsy DeVos), is a national voucher program. As DeVos recently announced, "We are just getting started."

Make

no mistake. The ultimate goal of this scam's proponents (who include

Ted Cruz and Betsy DeVos), is a national voucher program. As DeVos recently announced, "We are just getting started."

The war on education does not end there.

Click here to send an email today.

Then make your call. You can find the phone numbers of your Senators here.

You can find the phone number for your House member here.

Keep it simple when calling:

As middle-class and poor students are left behind in public schools, public school funding will drop.

Fight for democracy. Fight for your public schools. Tell Congress that you do not want your tax dollars going to the wealthy to send their children to private and religious schools.

The stakes could not be higher.

If the GOP tax bill passes, your federal tax dollars will be used to support the private and religious school tuition of any student, no matter how wealthy, in every state.

The tax bills of both the House and Senate would allow wealthy families like the Trumps and the DeVoses to divert up to $10,000 a year in taxable dollars to pay K-12 private school tuition.

What the rich should pay in taxes, will instead pay for elite private and religious school tuition--even to schools that discriminate against students based on race, religion, gender, primary language, disability and LGBTQ status. The wealthy could take advantage of this tax scam before their child is even born.

Tell your representatives to take out the expansion of 529 accounts. Tell them to fully restore the SALT deduction instead. Send your email here.

Make

no mistake. The ultimate goal of this scam's proponents (who include

Ted Cruz and Betsy DeVos), is a national voucher program. As DeVos recently announced, "We are just getting started."

Make

no mistake. The ultimate goal of this scam's proponents (who include

Ted Cruz and Betsy DeVos), is a national voucher program. As DeVos recently announced, "We are just getting started."The war on education does not end there.

- Both the House and Senate bills dramatically lower the federal deduction for state and local taxes (SALT), making it tougher to raise funds for public schools. That means that you will be taxed on part of your income that was already taxed to support public schools.

- The House bill also eliminates the tax deduction for student loan interest, taxes tuition waivers as income, and eliminates the small tax credit for teachers to buy school supplies.

Click here to send an email today.

Then make your call. You can find the phone numbers of your Senators here.

You can find the phone number for your House member here.

Keep it simple when calling:

"I am calling to express my opposition to the tax bill. I support public schools and oppose the expansion of 529 accounts for K-12 private school tuition. Restore the SALT deduction instead."Act today.

As middle-class and poor students are left behind in public schools, public school funding will drop.

Fight for democracy. Fight for your public schools. Tell Congress that you do not want your tax dollars going to the wealthy to send their children to private and religious schools.

Comments

If people are able to designate $10k as tax-exempt for education, that does not mean someone else is paying their private school tuition. It just means their tax bill might go down a few thousand dollars from the probably-hefty amount they will likely still owe (although it might go up for other reasons TBD). People who get this tax break will still be responsible for paying taxes (probably lots of them) and they will still be responsible for paying their private school tuition themselves.

(To be fair, public school parents are the ones getting the education tax break now--and your public education actually is partly subsidized by private school parents. I'm fine with that because I value a strong public education system, but it's kind of ironic, isn't it?)

seasick

Seasick

Also don't forget that the public school taxes I pay are currently deductible as part of the State and Local Tax deduction. The Republican tax plan wants to eliminate the deduction for public school taxes paid while creating a brand new deduction for private school tuition? That's truly grotesque.

FNH

CT